The cultivated meat industry faced a tough year in 2025. Funding dropped sharply, with only £28 million raised in the first nine months, compared to £1 billion in 2021. Investors are now demanding immediate progress, focusing on cost reductions, regulatory approvals, and market readiness. While some companies like Mosa Meat secured funding for expansion, others, such as Meatable, shut down due to financial struggles. Europe led funding efforts, while North America saw a decline, and the Middle East prioritised long-term investments for food security.

Key points:

- Funding fell by 80% since 2021, with just £175,000 raised in Q3 2025.

- Europe emerged as the top region for investment, with strong government backing.

- Companies are focusing on hybrid products and cost-efficient scaling to stay afloat.

- Regulatory delays and technical challenges remain major hurdles.

The sector's future depends on balancing private funding, public support, and consumer education to achieve commercial viability.

Cultivated Meat Funding Decline 2021-2025: Investment Trends by Year and Region

2025 Funding Overview for Cultivated Meat

Investment Figures and Comparisons

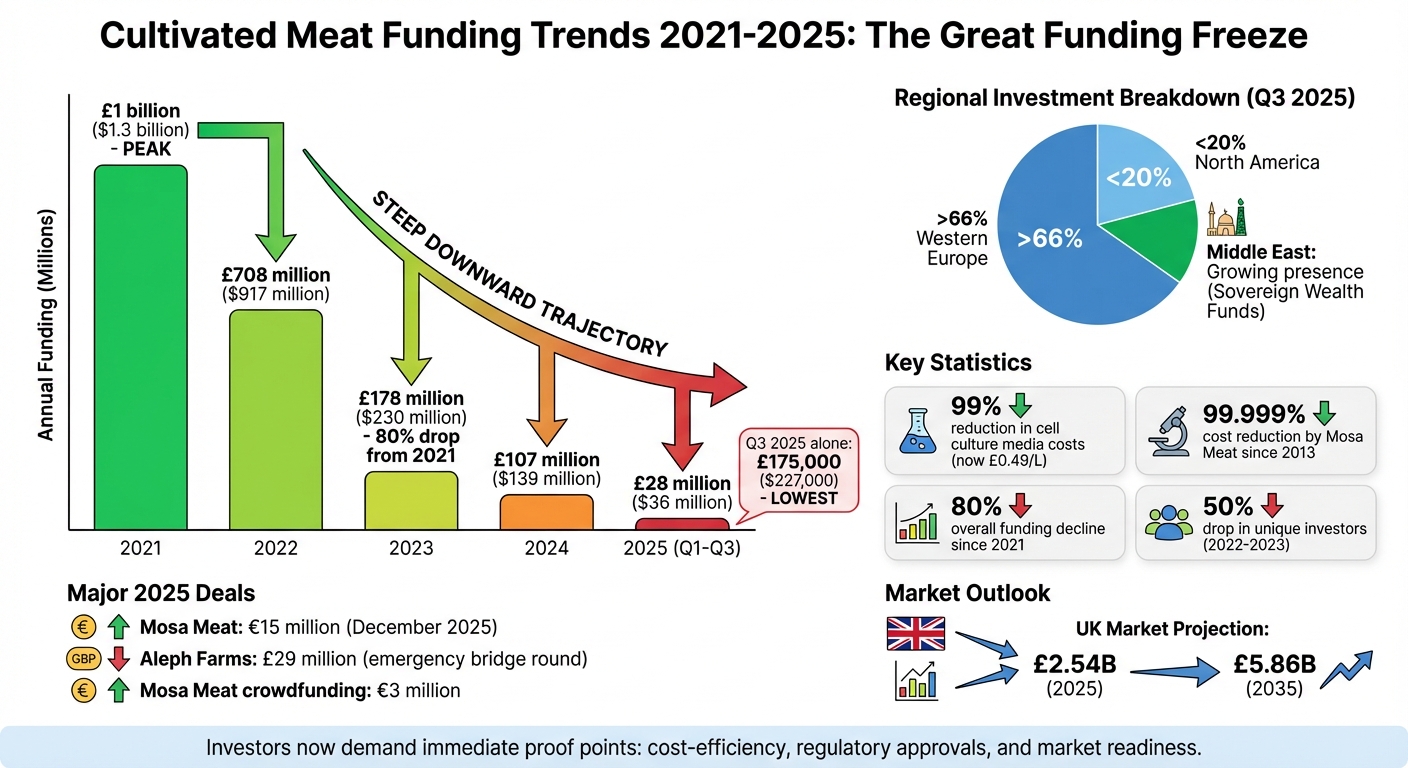

The cultivated meat industry saw a significant funding drop in the first nine months of 2025, raising just £28 million ($36 million) [5]. This marks a sharp decline compared to its peak years. Back in 2021, the sector secured £1 billion ($1.3 billion), but funding has been on a steep downward trajectory since. It fell to £708 million ($917 million) in 2022, then plummeted by 80% to £178 million ($230 million) in 2023. By 2024, it had dropped further to £107 million ($139 million), with only £175,000 ($227,000) raised in Q3 2025 [3][4][5].

To put this into context, the electric vehicle industry raised more in just the first three quarters of 2024 than the cultivated meat sector has managed to secure across its entire history [6][4]. This dramatic decline has pushed investors to demand more immediate and measurable results.

What's Driving Investment in 2025

Investor expectations have shifted dramatically. According to Daniel Gertner from the Good Food Institute, investors are now prioritising "near-term proof points." This means companies must demonstrate progress in areas like cost-efficiency, regulatory approvals, and consumer adoption before securing funding [5].

This change is partly due to broader market pressures. Higher interest rates and the growing appeal of sectors like artificial intelligence have tightened the availability of venture capital [7]. Despite these challenges, there are some encouraging signs. For instance, the cost of cell culture media - a critical component for cultivated meat production - has dropped by over 99%, now costing around £0.49 per litre ($0.63/L) [4]. Regulatory approvals in countries such as the US, Israel, and Singapore have also added credibility to the sector [4][6].

However, private funding alone is proving insufficient to scale production. As a result, companies are looking to alternative funding sources, including crowdfunding, government grants, and sovereign wealth funds, to bridge the gap [4][2].

Major Funding Deals in 2025

Largest Funding Rounds

Even with an overall decline in funding, some companies managed to secure major investments in 2025, highlighting areas of progress within the sector. Mosa Meat stood out with a €15 million funding extension in December 2025, bringing its total raised to €58 million over two years [8][11]. The round was backed by Dutch state-owned impact investors Invest-NL and LIOF, alongside strategic partners like PHW Group and Jitse Groen, the CEO of Just Eat Takeaway.com [8][9].

"Today, through fundamental scientific breakthroughs and scaling efficiencies, we are producing burgers at a price point ready for restaurant menus." – Maarten Bosch, CEO, Mosa Meat [8]

This funding will help Mosa Meat secure regulatory approvals in markets like the UK, European Union, Switzerland, and Singapore. It will also support the company’s production scale-up, increasing bioreactor capacity from 1,000 to 5,000 litres [8][9]. Impressively, Mosa Meat reported a 99.999% reduction in production costs compared to its 2013 proof-of-concept burger, which had cost around €250,000 [8][10].

Aleph Farms also managed to navigate the tough funding climate, raising £29 million in an emergency bridge round in 2025 [2]. Meanwhile, Australian company Vow closed a funding round in January 2025, following regulatory approvals for its cultured quail product in multiple markets [2].

New Brands Receiving Investment

Mosa Meat's early 2025 crowdfunding campaign demonstrated strong retail investor interest, raising €1.5 million within minutes and surpassing €3 million overall [2][12].

However, the funding environment proved less forgiving for newer players. The sector saw consolidation as Dutch startups Meatable and Believer Meats shut down in late 2025 after failing to secure fresh capital [9][10][11]. These closures reflect the dual reality of growing retail enthusiasm for the industry and the challenges faced by emerging brands, offering a glimpse into the hurdles consumer-facing companies must overcome.

2023 State of the Industry: Cultivated meat and seafood

sbb-itb-c323ed3

Where Investment is Happening: Regional Breakdown

By the third quarter of 2025, more than two-thirds of funding for alternative proteins was directed towards companies in Western Europe. Meanwhile, businesses in the United States managed to secure less than 20% of the total investment [5]. This marks a significant shift from North America's previous leadership in the sector, highlighting differing regional approaches to regulation, food security, and commercial readiness. Let’s take a closer look at how these investment trends are playing out across North America, Europe, and the Middle East.

North America

The alternative protein sector in North America saw a noticeable downturn in 2025, despite earlier regulatory achievements. US-based companies captured only a fifth of the funding in Q3 2025 [5]. Firms like Upside Foods hit the brakes on large-scale expansion plans, while others, such as Finless Foods, had to downsize or even shut down due to a lack of capital [2]. Adding to the uncertainty were state-level bans in places like Florida and Alabama, which further dampened investor confidence [6]. Some relief came in the form of federal research grants and the USDA's cultivated meat consortium, launched in late 2024 [2]. However, traditional venture capital funding in the region continued to decline.

Europe

While North America faced challenges, Europe experienced a surge in investment within the cultivated meat sector. By 2025, Europe had become the leading region for such funding, with strong activity in countries like the Netherlands and the UK. However, the market remained unpredictable. For instance, Dutch startup Meatable collapsed in late 2025 after failing to secure additional funding from its board and shareholders, including Agronomics [14]. On the other hand, some companies thrived, with the UK government allocating £12 million to establish a cultivated meat research hub at Bath University [2].

Daniel Gertner, Lead Economic and Industry Analyst at the Good Food Institute, commented on this trend:

"Capital continues to flow to select, well-positioned companies with differentiated tech, credible paths towards progress on taste and price, and commercial traction" [5].

The European Union's cautious regulatory approach still influences investment decisions, as there are no approvals for human consumption yet. However, Mosa Meat anticipates receiving EU approval by mid-2026 [2].

Middle East

In the Middle East, sovereign wealth funds from countries like the UAE, Qatar, and Saudi Arabia are increasingly viewing cultivated meat as essential for regional food security [3]. These funds are moving beyond passive investments, actively partnering to build production hubs across the Gulf [3]. Unlike traditional venture capital, Middle Eastern investors are taking a long-term approach, prioritising national food security over immediate commercial success [2]. Through state-backed collaborations with Western startups, the region is positioning itself as a global hub for production and distribution [2].

What Consumer-Facing Brands Are Up Against

Main Obstacles

Consumer-facing brands in the cultivated meat sector are navigating a tough landscape, particularly following the regional funding review. Private investment has taken a sharp dive, dropping from £1.0 billion in 2021 to just £110 million in 2024. On top of that, the number of unique investors almost halved between 2022 and 2023 [4][3]. It's become clear that relying solely on venture capital won't cut it when it comes to building the large-scale production facilities required for a commercial rollout.

"It is increasingly clear that private funding alone will be insufficient to fully fund first-of-a-kind cultivated meat facilities." – The Good Food Institute (GFI) [4]

Regulatory hurdles are another significant challenge. The lengthy, product-specific approval processes often can't keep up with the pace of technological advancements, potentially leaving approvals outdated before products even hit the market [13]. Didier Toubia, CEO of Aleph Farms, summed it up well:

"A few companies assumed it [regulatory approval] would take less time and burnt a lot of money preparing for launching" [13]

Adding to the pressure, 2024 saw 14 bills introduced across 12 U.S. states aimed at banning cultivated meat altogether [1].

Technical challenges are also slowing progress. Scaling up bioreactors is no easy feat, with issues like metabolite buildup and the complexities of creating structured products posing significant barriers. While media costs have dropped to around £0.50 per litre [16][4], many brands are focusing on simpler formats - like nuggets and mince - to get their products to market faster.

Growth Opportunities

Even with these hurdles, there are promising signs of growth. The UK cultivated food market is expected to expand from £2.54 billion in 2025 to £5.86 billion by 2035 [15]. Although only 15% of consumers currently recognise cultivated meat, introducing them to the concept increases their willingness to buy to between 30% and 60% [17]. This gap highlights the potential for early education and engagement to drive adoption.

Hybrid products are helping to bridge the gap between production limitations and consumer expectations. By combining small amounts of cultivated meat with plant-based ingredients, brands can address cost and texture issues. For instance, in May 2024, GOOD Meat launched "GOOD Meat 3" in Singapore, a frozen product blending 3% cultivated chicken with plant-based components. This marked the first retail launch of a cultivated meat product in the frozen aisle [1][6]. Such products give consumers a taste of the future while production scales up.

Public enthusiasm for the sector is also evident. For example, Mosa Meat raised over €1.5 million through crowdfunding in early 2025 [3]. Platforms like Cultivated Meat Shop are stepping in to educate consumers, offering clear and accessible information about what cultivated meat is and how it compares to traditional meat. These efforts are key to building trust and preparing the market for widespread adoption.

With these opportunities, alongside efforts to overcome technical and regulatory challenges, the cultivated meat sector is laying the groundwork for future growth and market readiness.

What 2025 Funding Trends Mean for the Future

The funding outlook for cultivated meat in 2025 paints a sobering picture. With just £28 million raised in the first three quarters of the year - and an especially low £180,000 in Q3 alone[5] - the sector has shifted gears. Instead of chasing speculative growth, companies are now under pressure to deliver immediate proof points. Investors are waiting for evidence of sustainable unit economics, regulatory progress, and clear consumer demand before committing further capital.

"A sustained upswing in private investments in alternative protein companies will rely on companies demonstrating credible paths to profitability and achieving tangible exits such as IPOs and strategic acquisitions." – Daniel Gertner, GFI[5]

This shift in focus has accelerated the sector's maturation. Companies like Aleph Farms and Vow are prioritising capital efficiency, refining their unit economics, and ensuring their products align with market needs, rather than simply pursuing additional funding rounds[13]. Meanwhile, advancements in infrastructure - such as deploying 20,000-litre bioreactors and shared facilities like The Cultured Hub in Switzerland - highlight progress in scaling production, even as funding remains tight[1].

However, private funding alone won't be enough to bring cultivated meat to scale. Achieving commercial viability will require a mix of public investment, philanthropic contributions, and strategic partnerships[4]. Consumer education is also playing a growing role in shaping investor confidence. Platforms like Cultivated Meat Shop are helping bridge the gap by informing shoppers about what cultivated meat is, how it’s produced, and why it matters. This kind of education builds the foundation for market readiness, which in turn could spur the next wave of investment.

The road ahead for cultivated meat hinges on more than just advances in technology and regulatory approvals. Success will also depend on fostering an informed and receptive customer base, ready to embrace these products when they finally hit the shelves.

FAQs

What caused the significant decline in cultivated meat funding in 2025?

The drop in funding for cultivated meat in 2025 stemmed from a combination of economic pressures, regulatory hurdles, and sector-specific issues. After a period of heavy investment in 2021, the landscape shifted dramatically by 2023, with global economic uncertainty, regulatory delays, and waning enthusiasm from venture capital leading to a sharp decline. While there was a slight recovery in 2024, investors remained cautious throughout 2025.

The sector's challenges were rooted in its high capital expenditure (CAPEX) demands, slow-moving regulatory approvals - particularly in regions like the US and EU - and limited prospects for short-term revenue. These factors, coupled with the collapse of major funding rounds, amplified concerns about the risks involved. In response, many startups pivoted towards cost-cutting measures and prioritised long-term strategies, which, despite the tough funding environment, managed to retain some investor interest.

Which regions are leading in cultivated meat investment in 2025?

In 2025, Europe and North America stand out as the top regions for cultivated meat investment. Europe has solidified its position as a major force, drawing considerable funding for alternative proteins, including cultivated meat. At the same time, North America - especially the United States - continues to be a key investment hub, even though funding levels have dipped slightly compared to previous years.

These regions maintain their leadership thanks to a combination of strong scientific expertise, advanced industrial capabilities, and established venture capital networks. Together, these factors create an environment that supports the continued development of the cultivated meat industry.

How are companies addressing challenges in the cultivated meat industry?

Companies in the cultivated meat sector are working hard to address challenges by cutting production costs, advancing technology, and expanding funding options. After a slowdown in investments post-2021-2022, many have turned their attention to refining biomanufacturing methods. These improvements aim to make production more efficient and scalable, which is crucial for overcoming financial pressures and meeting regulatory requirements.

Another notable shift is the rise in regional investment, with Europe poised to play a major role by 2025. Businesses are also forming strategic partnerships, allowing them to share expenses and speed up innovation. While funding hurdles remain, these strategies are helping the industry strengthen its foundation and maintain growth momentum over time.